ATTENTION: Renters And Those Still Living At Home Who Want To Get Into Their First Home Sooner Than They Thought Possible

How To Own Your First Home In 90 Days — Just Like Dozens Of First-Time Buyers On Regular Incomes Are Doing Right Now With As Little As 5% Deposit — Even Without Renting History Or Help From Rich Parents

Learn How To Access The Same Government Grants And Incentives Thousands Of Aussies Are Using — And Uncover The Path To Homeownership That Was Built For First-Time Buyers Like You

See How Australians Just Like You Are Turning 5% Deposits Into First Homes — Without Needing A Six-Figure Savings Account, Rich Parents Or Navigating Lender Jargon Alone

Execution Case Study:

Meet Emily & Josh — A Teacher and an Electrician Who Bought Their First Home With Just a 5% Deposit.

Emily and Josh were both in their early 30s, earning just under $140K combined. They thought they’d be renting for years — until they discovered they qualified for a government-backed scheme and could buy sooner than they thought.

With our help, they secured a $620K home in outer Melbourne with just a 5% deposit, avoided paying LMI, and were handed the keys in under 90 days.

Now they’re building equity in their own home — not someone else’s.

Let's Look At Two Paths...

You’re not just paying for a roof over your head — you’re investing in your future.

You’re building something that belongs to you — and setting yourself up for long-term financial growth.

You didn’t save just to let that money sit — you saved to move forward. And this is where your savings finally start working harder for you.

Instead of sitting in a bank account slowly losing value to inflation, they become the foundation of something real: a home, financial stability, and a future you can build on.

Discover How Everyday Australians On Regular Incomes Are Buying Their First Home Sooner

Book A Quick Chat To See The Government Grants That You Are Entitled To And How You Could Start Building Wealth With Just a 5% Deposit And The Right Support Behind You

We Help First-Time Buyers Escape The Rental Trap And Enter The Property Market With Confidence…

Implement The Proven FirstHomePath™ System That’s Helped Aspiring Homeowners Secure Properties In As Little As 90 Days — Even With Just 5% Deposit

You deserve more than rent receipts or share-living at home.

You need a step-by-step system to access everything you’re entitled to and get into the market with just a 5% deposit — without relying on handouts, a six-figure salary, or feeling like you’re the only one being left behind.

Because let’s be honest — we’ve all heard it: “They must have rich parents.” And for many, that’s exactly how they got in.

But that doesn’t have to be your story — and with the right support, it won’t be.

Here’s Exactly What We Guide You Through Inside FirstHomePath™:

Your Personal First Home Strategy Session

We start with a personalised First Home Strategy Session to unpack your financial position, goals, and ideal timelines.

Whether you're buying solo or as a couple, we map out a clear plan tailored to your income, lifestyle, and property ambitions.

This isn’t generic advice — it’s a strategic roadmap to help you stop renting and start owning in as little as 90 days.

Eligibility Check For Grants, Schemes & Low-Deposit Options

We conduct a full eligibility analysis to access the same grants and incentives that thousands of Aussies are using — including the First Home Guarantee and shared equity programs.

This potentially saves you up to $30,000 and eliminating Lenders Mortgage Insurance.

Most renters don’t know they qualify. We make sure you do — and that you leverage every benefit to your advantage.

Borrowing Capacity & Safe Repayment Modelling

We run detailed borrowing assessments across multiple lenders to determine your true borrowing power — not just what a bank tells you.

Then we build a safe repayment plan that keeps you financially secure, even with rising interest rates.

No guesswork. No hidden risks. Just clarity and control from day one.

Smart Lender Matching & Loan Product Selection

We compare loan products from a wide panel of lenders — specifically targeting those that fully support first-time home buyers in today's market.

This isn’t about just getting any loan — it’s about getting the right structure, rate, and conditions to set you up for long-term success and fast-track your equity growth.

End-to-End Application, Approval & Settlement Support

Once you're ready to go, we handle the full loan application process — from document collection through to approval and settlement.

You’ll avoid the usual back-and-forth with banks, endless paperwork, and costly delays.

We stay by your side until the keys are in your hand — ensuring nothing falls through the cracks.

From the Desk of

Michael Jamison

Senior Broker, Finance 48

First Home Buyer Specialist

The biggest problem stopping young Australians from owning property today?

It’s not just high prices — it’s confusion. Misinformation. And a constant sense that you’ve missed the boat.

You’ve probably been told you need a 20% deposit. That you should wait until the market drops. That you’ll never get approved with less than perfect financials.

But here’s the truth: the longer you wait, the more you lose.

Every month spent renting is a month you’re funding someone else’s investment — while property prices continue to rise and equity-building opportunities slip further out of reach.

After helping hundreds of first-home buyers across Australia step into the market, we see the same thing over and over again…

Smart, capable people stuck in limbo — not because they lack discipline, but because the system is overwhelming, fragmented, and designed for people who already own property.

They try speaking to their bank…

They get half-answers from online calculators…

They scroll endlessly through articles, grants, and schemes — none of it personalised to them.

And meanwhile, people around them are somehow buying homes.

You hear it all the time: “They must have rich parents.” And let’s be honest — sometimes, that’s true.

But it doesn’t make it any less frustrating when you're working hard, saving what you can, and still feeling locked out.

FirstHomePath™ is built for the ones who don’t have a family safety net — the ones doing it on their own and just need someone to show them how.

The reality? It’s not your fault.

Buying your first home isn’t something you should be expected to figure out on your own.

From eligibility rules to lender criteria, deposit shortcuts to approval pitfalls — it’s a minefield.

And making the wrong move can set you back years.

That’s why I built FirstHomePath™ —A done-for-you system that guides you step-by-step through everything:

✅ Strategy sessions

✅ Government grants that were built FOR YOU and that you are ENTITLED to

✅ Borrowing capacity

✅ Lender matching

✅ Application & approval

✅ Right through to settlement

This isn’t just another mortgage broker service.

It’s your shortcut to ownership — without the fear, overwhelm, or missed opportunities.

We simplify the complex.

We maximise your borrowing potential.

And we help you get into a property that could grow $100k–$200k in equity within just 3 years — not 10.

Because your future shouldn’t be delayed by myths, misinformation, or hesitation.

It should be built now — with expert support, smart strategy, and a clear path forward.

When you’ve spent years scraping together every spare dollar for your deposit, the idea of spending it can feel terrifying.

But buying a home isn’t about letting go of your savings — it’s about putting them to work.

Your deposit becomes a stake in something that grows. You’re not just buying a house. You’re building a future.

Let’s break the rental cycle — and get you on the property ladder.

"We Take The Entire First-Home Buying Process And Build It Around You, Start To Finish"

You don’t need to spend months researching lenders, reading confusing government scheme guidelines, or second-guessing whether your deposit is “enough.”

Buying your first home isn’t just about getting a loan — it’s about having a proven strategy that gets you into the market safely and sooner.

That’s exactly what FirstHomePath™ delivers.

We’ve worked with dozens of first-home buyers across Australia who were stuck renting, unsure if they’d ever qualify. We know the exact roadblocks, the myths that keep people out of the market, and the costly mistakes to avoid.

We’ve built the process behind the scenes — eligibility checks, lender comparisons, borrowing assessments, and end-to-end loan management — and tailored it specifically for young professionals who want to stop renting and start building equity.

You could try to piece this together yourself.

You could spend countless hours chasing information from banks, brokers, and government sites — hoping you’re making the right decisions.

Or you can shortcut the entire process by working with experts who know the system inside and out — and who’ve helped people just like you move from stuck renter to confident homeowner, without the stress or guesswork.

Because timing matters.

And the sooner you step into the market with a smart plan, the sooner your future starts working for you.

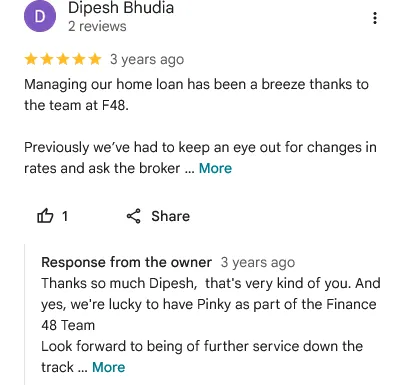

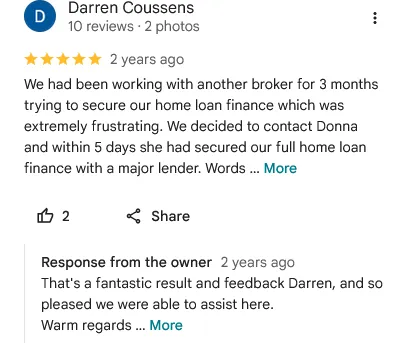

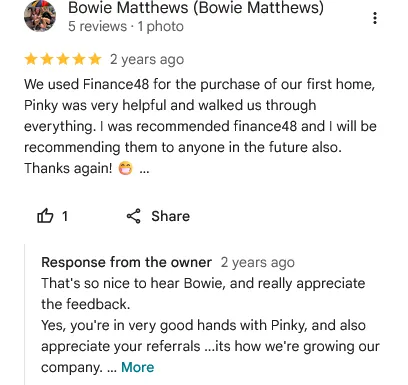

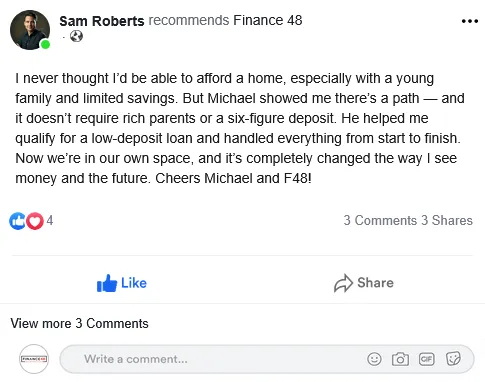

But Don't Just Take Our Word For It....

Execution Case Studies

How a Young Couple in Brisbane Bought Their First Home on Two Average Incomes — With Just 5% Deposit and Zero LMI

Sarah (a teacher) and Luke (a mechanic) had been renting in Brisbane for over six years. With a combined income under $140K and less than $40K saved, they thought homeownership was still years away.

Using FirstHomePath™, we uncovered their eligibility for the First Home Guarantee and matched them with a lender who accepted a 5% deposit with no LMI.

In just 84 days, they settled on a $700K home — and their suburb has already seen $50K in capital growth.

What made the difference? The right system, support, and a strategy built for real people — not just high-income earners.

We Personally Use This Same System To Help Clients Enter The Market With Confidence, Month After Month

We practise what we preach — FirstHomePath™ isn’t just a concept, it’s a battle-tested system that we run day in, day out for our own pipeline of first-home clients.

We know the schemes. We know the lender appetites. We know the timelines, traps, and missed steps that stall approvals — and we’ve refined our process to eliminate them.

Our team uses this same step-by-step system to assess eligibility, secure fast pre-approvals, and take clients from “unsure renter” to confident homeowner in a matter of weeks.

The best part? Because the process is systemised, we’re able to keep delivering consistent results across all markets — even with rising rates, changing scheme rules, and shifting lender policies.

This isn’t theory. It’s tested, proven, and in action every single week — and when you book your First Home Strategy Session, we’ll show you exactly how it could work for you.

"Get Into Your First Home Faster With A Battle-Tested System Built To Eliminate The Guesswork"

The key to breaking free from renting is having a proven home buying process that removes confusion, accelerates approvals, and leverages every available scheme.

With FirstHomePath™, we deploy a step-by-step system built specifically for first-home buyers.

From eligibility checks and lender matching to loan approval and settlement, we handle everything — so you can stop waiting and start building equity sooner.

Learn How To Secure Your First Home With As Little As 5% Deposit — And Start Building Equity In Just 90 Days

Stop renting and start owning with a proven process designed specifically for first-home buyers.

FirstHomePath™ shows you exactly how to access government-backed schemes, avoid unnecessary LMI costs, and get approved with a low deposit — even if you thought the market had moved beyond your reach.

This is the fastest way to take control, get on the property ladder, and begin building long-term wealth through homeownership.

The FirstHomePath™ Buying Process

Your Personal Strategy Session

We start by understanding your goals, current finances, and ideal timeline.

This isn’t generic advice — it’s a 1:1 strategic deep dive that maps out exactly how you can move from renting to owning, faster than you thought possible.

We identify what’s holding you back and build a tailored roadmap to get you on the property ladder.

Unlocking Your Eligibility & Borrowing Power

Next, we run detailed assessments to uncover which grants, schemes, and low-deposit options you qualify for — and what your safe borrowing limit actually looks like.

Most first-home buyers miss out on thousands in benefits simply because they don’t know what’s available. We make sure you don’t.

Matching You Up With The Right Lender

With your numbers in hand, we compare loan products across a panel of lenders who fully support first-time home buyer applicants.

We look at rates, structure, and lender criteria to ensure your application is positioned for fast approval and long-term affordability — not just a quick yes.

End-to-End Application & Approval Support

Once the right loan is selected, we manage the entire process — application, documentation, approvals, and negotiation — to ensure everything runs smoothly.

You’ll avoid delays, missed paperwork, and constant back-and-forth with banks. We stay in your corner until you’re fully approved.

From Settlement To Keys In Hand — Your New Chapter Starts Here

This is where it all comes together — the final steps to unlocking your new home.

We manage everything behind the scenes, from dealing with your conveyancer to finalising the settlement.

You stay focused on what matters: planning the move, choosing furniture, and finally stepping through the front door of a place that’s yours.

Client Results:

Check Out Some Feedback Provided By Our Clients...

Frequently Asked Questions:

Do I really need a 20% deposit to buy my first home — because everyone else seems to have one?

No — and most of our clients didn’t either. We work with nurses, tradies, retail managers, junior consultants, self-employed business owners — everyday Australians who thought they were behind until they saw what was actually possible. With FirstHomePath™, many secure their first home with just 5% deposit by leveraging the right lender and government scheme. If they can do it, you absolutely can too.

What if I don’t know how much I can borrow yet?

That’s exactly what we cover in the early stage of the process. We run a detailed borrowing capacity assessment based on your current income, financials, and lifestyle goals. You'll know exactly how much you can safely borrow — and what repayments will look like — before taking the next step.

I’m not sure if I qualify for any grants or schemes — can you help?

Absolutely. One of the first things we do inside FirstHomePath™ is run a comprehensive eligibility check across all national and state-based first-home buyer schemes. You might be surprised at what you’re entitled to — some clients save $20,000–$30,000 through support they didn’t even know existed.

Can I still buy if I have debts or a lower income?

Yes — in many cases. We work with a wide panel of lenders, including those that are more flexible with low-deposit buyers or clients with minor credit issues. We’ll assess your financial picture and help you understand what’s realistic — then structure the application to maximise your chance of approval.

How long does the entire process usually take?

Our clients typically go from initial strategy session to settlement in 60–90 days. The exact timeline depends on your readiness, the property search, and lender turnaround times — but we manage the entire process to keep things on track and stress-free.

I’m overwhelmed by the paperwork — can you handle that?

Yes, and that’s a key part of what makes FirstHomePath™ different. We manage the full loan application, approval, and settlement process for you — including gathering documents, communicating with lenders, and making sure everything is submitted accurately and on time.

What if I’ve already spoken to a bank or broker?

That’s fine — but banks only offer their own products, and many brokers don’t specialise in first-home buyers. We bring a first-home-specific strategy, know how to navigate deposit myths, and give you access to lenders who support buyers just like you.

Is now actually a good time to buy?

Waiting can cost you more than acting. Delaying by just 2–3 years could mean missing out on $60k–$150k in capital growth. Our job is to help you buy safely and strategically — not just quickly — so you’re building equity, not watching from the sidelines.

Do you only help buyers in certain states or cities?

We work with first-home buyers Australia-wide — whether you're in Sydney, Brisbane, Melbourne, or a regional growth corridor. The grants and lender options may vary by state, but our system is designed to work wherever you are.

I’ve worked so hard to save — what if I’m scared to spend it all?

You're not alone — almost every first-home buyer we speak to feels the same way. That’s why we focus on showing you how your deposit becomes a launchpad for building long-term equity. With the right plan, that money doesn’t disappear — it transforms into ownership, stability, and a foothold in a growing market.

What happens after I book my First Home Strategy Session — and will it actually help someone like me?

Yes — and that’s exactly the point. In your strategy session, we unpack your goals, income, and financial picture — just like we’ve done for hundreds of young professionals, teachers, nurses, retail workers, and everyday couples who thought they couldn’t buy either. You’ll walk away with a personalised roadmap, knowing exactly what’s possible — and how to move forward with confidence.

© Copyright 2025 Finance 48. All rights reserved.

Reproduction or duplication of this website or contents is strictly prohibited.

View Privacy Policy & Terms

Credit Representative 504696 is authorised under Australian Credit Licence 386685.

Disclaimer: Your full financial situation would need to be reviewed prior to acceptance of any offer or product.